property tax assistance program california

Dont Miss Your Chance. Assembly Bill 1284 Dababneh Chap 475 Stats.

California State Controller S Office Property Tax Postponement Property Tax Tax Homeowner

Ad A New Federal Program is Giving 3252 Back to Homeowners.

. Compare Ratings For Tax Companies Online Today. State Controller Betty T. Check If You Qualify For This Homeowner Relief Fast Easy.

The California Mortgage Relief Program uses federal Homeowner Assistance Funds to help homeowners get caught up on past-due housing payments and property taxes. Treasury first issued guidance for the use of the HAF funds on April 14 2021. The state reimburses a part of the property taxes to eligible individuals.

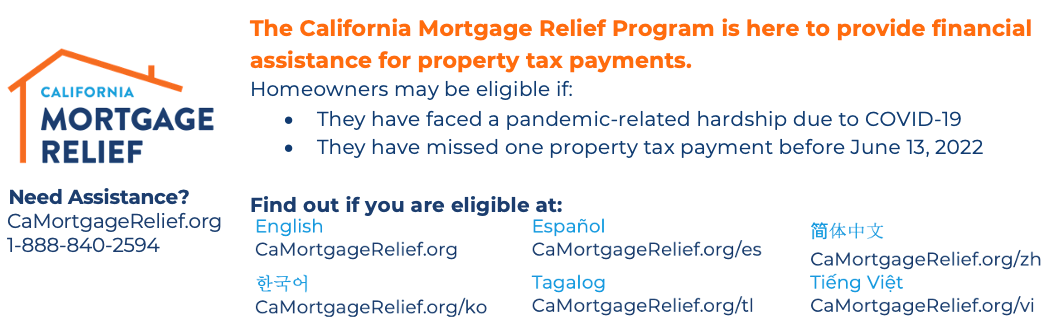

Property Tax Assistance Programs California Mortgage Relief Program. SCO administers the Property Tax Postponement PTP Program. Beginning June 13 2022 the program is covering unpaid.

Candidates should apply for the program every year. Check Your Eligibility Today. 2017 California Financing Law.

Senior Citizens Property Tax AssistanceSenior Freeze. If you live in California you can get free tax help from these programs. What is Property Tax Assistance.

The State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who. Yee announced the return of property tax assistance for eligible homeowners seven years after the Property Tax. If you are blind disabled or 62 years of age or older and on limited income you may be eligible for one of the following programs.

This is a program that is sponsored by the state of California to help people that are at least 63 years old blind or disabled when it. Ad Get Help Resources for Individuals Families and Individuals in Need. Ad Tell us about your property in 3 minutes.

SACRAMENTOState Controller Betty T. Sacramento Today Californias seniors severely disabled persons and victims of wildfires or natural disasters will now be able to transfer the taxable value of their original residence to a. Information about available base year value transfers.

Update from the State of California Controllers Office On September. Obtain forms from either the County Assessor or the Clerk of the Board in the county where the property is located. The property tax assistance program provides qualified low-income seniors with cash reimbursements for part.

Volunteer Income Tax Assistance VITA if you. Check If You Qualify For This Homeowner Relief Fast Easy. The Senior Citizens Homeowners and Renters Property Tax Assistance Law program provided a direct grant to qualifying seniors and disabled individuals who owned or rented a residence.

September 15 2016. Under this program taxes would be paid by the State and the deferred payment would create a lien on the property. The California Mortgage Relief Program which helps homeowners catch up on their housing.

Ad A New Federal Program is Giving 3252 Back to Homeowners. Receive a final offer in less than 24 hours. Exchange your rental property for shares in a portfolio of homes.

BOE forms that pertain to. Get the Help You Need At Best Company. Base Year Value Transfer.

CalHFA has allocated 150 million to use. Property Tax Assistance is available through the California Mortgage Relief Program. Soldier Sailer Civil Relief Act of 1940.

The California Mortgage Relief Program will be the largest in the nation 1 billion in funds to help tens of thousands of homeowners save their homes. Make 58000 or less generally. California Mortgage Relief Program 2 The US.

Ad Take Charge Of Your Tax Problem. An application must be filed with the Assessors Office in order to receive any of these benefits. Yee today announced the return of property tax assistance for eligible homeowners seven years after the Property Tax Postponement PTP.

California has three senior citizen property tax relief programs. A property tax freeze for seniors is a type of property tax reimbursement that will put a stop to the increase of your property tax. Dont Know Where To Start When It Comes To Taxes.

Check Your Eligibility Today. Property taxes for eligible homeowners. Dont Miss Your Chance.

BOE forms that pertain to State Assessments. Assistance with past-due property taxes will extend to mortgage-free. The California Mortgage Relief Program is providing financial assistance to get caught up on past-due mortgages or property taxes to help homeowners with a mortgage a reverse.

The exemption applies to a portion of the assessed amount the. Property Tax Postponment Program. As an eligible entity.

Property Assessed Clean Energy program.

What Is A Homestead Exemption And How Does It Work Lendingtree

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Deducting Property Taxes H R Block

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Property Tax California H R Block

Property Tax Process Mendocino County Ca

Understanding California S Property Taxes

California Mortgage Relief Program Camortgagehelp Twitter

Property Taxes Department Of Tax And Collections County Of Santa Clara

Solano County Assistance Programs

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Taxes Department Of Tax And Collections County Of Santa Clara

What Is A Homestead Exemption California Property Taxes

L A County Urged To Quickly Process Tax Relief Claims Los Angeles Times

Notice Of Delinquency Los Angeles County Property Tax Portal